What’s Next in Financial Services Innovation? Embedded Finance Fuses with Payroll

Payroll has long been considered a mundane requirement of doing business — an administrative, compliance task for all companies with employees.

For the remainder of this decade, the financial services industry will witness a transformation in payroll.

With direct access to salary/wage flows, embedded finance in payroll unlocks mulitiple financial products that improve the operations of businesses (employers) and user engagement (with employees).

In this deep dive, we explore (TL;DR):

The state of embedded finance in payroll;

Analyze key trends and recent innovations;

A roadmap for payroll & HR companies to embed financial services in 2026.

We’ll also include practical considerations, product use cases, risk challenges, and strategic timing for HR tech firms.

Why Wage Flows Excel as Embedded Finance Anchors

Payroll is emerging as THE most direct, sticky, and impactful money movement in financial services.

Since payroll touches each employer, worker, and involves recurring, predictable flows — it’s an evergreen area to embed payments, banking, savings, and credit services.

Here’s a quick breakdown:

Sticky distribution channel: Every employer must run payroll regularly. If your system is part of that workflow, you become mission critical.

Rich financial data: Payroll systems know salary, bonus, tenure, deductions, employment status — this data powers underwriting, personalized offerings, and risk modeling.

Authorizing flow of funds: Because payroll involves money movement, embedding adjacent financial rails (e.g. wallets, disbursements, feeds to bank accounts) is a natural extension.

Cross-sell opportunities: After payroll is embedded, firms can layer in lending, savings, insurance, and financial wellness.

So, what’s the catch?

Embedding finance into payroll demands modern APIs, regulatory readiness, fraud controls, and integration with HR systems.

The reward for this heavy lift: lifetime retention, multiple monetization levers, and transforming payroll from a cost center to a growth engine.

As we continue the discussion, it will become clear how payroll no longer a ‘check-the-box’ task for paying employees.

It’s becoming the financial backbone for next-generation embedded finance ecosystems.

For payroll/HR companies, fully understanding this shift is the first step we’ll cover — followed by how to do this at the start of 2026.

Embedded Finance Use Cases in Payroll: What’s Live, What’s Emerging

Before you build, it helps to know the range of embedded finance use cases in payroll today.

These go beyond mere payment automation into real financial services, often blending HR functionality with banking rails. Here are the core models to watch and potentially incorporate.

Key Use Cases

Earned Wage Access (EWA) / On-Demand Pay

One of the most prominent use cases: giving employees access to wages they’ve already earned before the official payday.

In effect, this embeds a “liquidity advance” within payroll itself.

EWA is improving the employer–employee dynamic, especially for hourly, contract workforce.

Employees benefit from reduced financial stress from not having to wait for payday;

Employers have a much more engaged workers, which lowers turnover and increases retention.

According to payroll and HCM trend reports, on-demand pay is expected to be a differentiation factor for HR systems in 2025 and beyond.

For HR/payroll systems, offering EWA means managing cash flow, underwriting risk (if advances are extended), and integrating real-time payroll data.

Some EWA providers partner closely with payroll platforms, while others build in direct rails.

Integrated Banking & Wallets

Rather than sending wages to external bank accounts, companies can host that account experience inside their platform.

In HR software, embedded finance is already allowing features like signing up for automated savings, managing payments, and facilitating small business financial services.

For global payroll, embedded wallets are a must-have as enable employees in underbanked regions to receive wages — even if they are unbanked.

The wallet becomes a layer of control — delivering seamless in-app payments, transfers, and value-add services (e.g. immediate payout of bonuses, expense reimbursements, etc.).

Embedded Lending (Wage-based Installment loans, Working Capital loans)

With payroll data and transaction history as inputs, offering small loans (to employees) or working capital (to employers) becomes viable.

Embedded lending is gaining popularity: platforms are offering loans directly in the tools users already use, reducing friction.

For payroll firms, lending is a natural expansion. Opportunties include: bridge capital to SMBs, or small consumer advances to employees in need of short-term liquidity.

Insurance, Benefits, and Wellness Products

Beyond lending & accounts, companies can also embed other finance-related products:

Insurance (e.g. income protection, short-term disability) offered at time of employee payout.

Savings and investments: 401(k), student loan repayment, and emergency savings accounts are top examples of funding long-term goals with weekly payroll.

Financial wellness and advice — this can include budgeting, coaching, or savings plans based on wages.

International Payroll & FX Integration

For firms with employees in multiple countries, embedded finance products can streamline global payroll:

Embedded FX conversion: wages to be paid out in local currency with real-time rates.

Instant disbursements: enabling various rails based on payment need (such as SWIFT, local transfers, or card networks) — all in one platform.

These models often combine with wallets and payout rails for maximal effect.

These use cases show the broad spectrum of embedded finance in payroll.

Not all payroll companies must adopt everything available. The key is to understand the overall model and what’s a best fit.

Next, let’s explore how to priortize product offerings.

Why Payroll / HR Firms Should Embed Finance in 2026

If you’re a payroll or HR provider thinking about embedding financial services — 2026 will be the year of action.

Considering the strategic, financial, and competitive benefits, the business model is too compelling to not act with urgency.

Monetization & New Revenue Streams

Payroll is a slim margin business. Embedded finance opens up multiple (recurring) revenue paths:

Interest income: when companies extend loans or hold user deposits within their platform.

Interchange revenue & transaction fees: on card spend (if a payroll company issues a card) and payment flows.

Subscription fees for premium services or bundled offerings (e.g. comes with bank account with high-yield interest).

Cross-selling of complementary products increase total revenue per user.

Because payroll is such a vital, core activity, the level of ‘stickiness’ enables increased user activity and multi-product opportunities. supports upsell and cross-sell.

Differentiation in a Saturated Field

The HR/payroll software market is getting more and more crowded as industry leaders (such as Gusto, Deel, Rippling, ADP) expand their programs, and new startup competitors emerge.

Embedded finance is such a compelling differentiator.

On-demand pay or banking features sets your company apart in vendor evaluations.

Reduces the friction for customers having to sign with additional providers.

Creates a deeper connection between payroll companies and financial workflows of clients.

Increased Retention & Customer Lock-in

We mentioned stickiness earlier with embedded finance in payroll.

The more embedded a platform, the higher switching cost for customers to move to a competitor offering.

In this sense, payrall & HR firms can go beyond a vendor relationship to a partner relationship.

Access to Financial Data Enables Custom Insights & Risk Scoring

So much detailed info is part of the payroll process.

The combined view of user & transaction data delivers a unique, full-scope view of financial activity and health — for empliyers and employees.

This contstnt flow of data can be utilized in underwriting, research, and retention efforts — with breakdowns by user segement & tiers.

FOMO is an All-Time High: New Fintechs & Banking Competitors are Dialed In

Not only fintech startups are increasing their activity level in combining payroll and embedded finance. Large industry players are also jumping into the arena.

U.S. Bank’s embedded payroll launch is one example.

ADP is actively branding an “Embedded Payroll” offer to its to new & existing software partners.

If HR/payroll firms decide to ‘wait & see’, emerging fintechs and banks will continue to grab market share.

Embedded finance becomes not only a tool for offense, but one that increases defensibility.

Embedding finance products into payroll programs is no longer a “nice to have” with possible benefits.

It’s becoming mission-critcal for payroll & HR platforms looking to grow sustainably.

Despite the numerous benefits, the path to building and launching embedded finance is complex. In the following sections, we share a walkthrough of key considerations, integration strategies, and a roadmap for 2026.

Key Considerations & Challenges When Embedding Finance into Payroll

While the opportunity is huge, embedding finance into payroll is not trivial.

Payroll and HR companies must navigate complexity across regulation, risk, architecture, partnerships, and adoption.

Below are key challenges and best practices to anticipate before launch.

A. Regulatory & Compliance Risk

Integrating financial services brings new regulatory obligations:

Banking / lending licenses: depending on your jurisdiction and whether you originate credit.

Money transmitter / payment license regimes: in many states / countries.

Consumer protection and disclosure rules: for earned wage access, advances, or fees.

Anti-money laundering (AML) / KYC / fraud controls: critical for wallets, transfers, and accounts.

Data privacy / consumer data protection (e.g. GDPR, CCPA): sensitive payroll and financial data must be guarded.

Labor & wage laws: offering advances or split pay must comply with wage and hour laws.

Best practice: partner early with compliance experts, consider building on BaaS (banking-as-a-service) or regulatory platforms, and start with lower-risk modules.

B. Risk & Credit Management

When you enable advances or loans, you absorb risk:

Use payroll history, cash flow data, deductions, and behavioral signals to build underwriting models.

Employ dynamic risk limits and guardrails to prevent overexposure.

Integrate real-time reconciliation so advances are reconciled with future payroll execution.

Monitor for fraud, identity misuse, and anomalous patterns.

“Embedded lending demands deeper risk engineering,” as analysts in embedded credit note. (lendflow.com)

C. Cash Flow & Liquidity Management

If your system pays out advances, you must fund those advances up front while awaiting repayment (likely via offset against future payroll).

This requires liquidity planning, partnering with banks, and perhaps lines of capital to smooth timing gaps.

D. API, Architecture, and Integration

HR/payroll platforms are legacy in many cases; embedding finance demands modern, modular, API-first architecture:

Microservices that can decouple finance modules from core payroll logic.

Secure, real-time APIs to money movement, identity, accounts, and reconciliation.

Event-driven architecture: triggers when wages are posted to lock advances or balance changes.

Integration with clients’ accounting systems, banks, and HRIS.

Versioning, rollback, observability, logging, and monitoring.

As one Tearsheet piece highlights, modular modernization is key in the payments/finance world. (Tearsheet)

E. Partnering vs Building In-House

Deciding whether to build the finance stack or partner with BaaS / fintechs:

Pros of partnering:

Faster time to market

Leverage compliance, risk, money movement, and banking infrastructure

Less capital investment upfront

Pros of building in-house:

Stronger control and differentiation

Better margins long-term

Ownership of customer experience

Many firms adopt a hybrid approach: begin with partners, validate use cases, then gradually internalize critical modules.

F. Security, Data Privacy, and Trust

You are dealing with payroll, salary, social security numbers, banking routing numbers, and sensitive behavior data. Security best practices are non-negotiable:

Encryption in transit and at rest

Role-based access control, least privilege

Audit logging, intrusion detection, anomaly protection

Third-party security audits and assessments

Transparent user consent and data usage policies

Building trust is also critical — customers must feel confident that your payroll system is safe from leak or misuse.

G. UX, Change Management, & Adoption

Embedding finance must feel seamless, not forced. Some challenges:

Educating HR/finance teams that accepting embedded finance is not adding complexity but delivering value.

UX flows that integrate financial prompts naturally (e.g. “Would you like to access 20% of your earned wages now?”)

Communication and marketing to workers to adopt wallets, EWA, etc.

Phased rollouts and pilot programs to gather feedback and tune.

H. Liability, Accounting, and Reconciliation

You'll need precise financial reconciliation, accounting for advances, repayments, reversals, service fees, and chargebacks.

Ensuring proper liability accounting is critical, especially when you embed multiple modules.

These challenges are formidable, but with careful design, strong partners, and phased execution, they are solvable.

In the next sections, I’ll outline a step-by-step roadmap to embed finance in 2026, and recommend prioritized modules for payroll/HR firms.

Roadmap & Implementation Plan for 2026

To bring embedded finance into payroll successfully, HR/payroll platforms should adopt a phased, practical roadmap.

Below is a recommended journey, aligned with market readiness, risk appetite, and technical maturity.

Phase 1: Foundations & Pilot (H1 2026)

(a) Strategy & Use Case Selection

Choose a focused MVP: e.g. earned wage access (EWA) or wallet/disbursement first.

Conduct market research and segmentation: which clients (size, industry, geography) are most receptive?

Build business case and financial model (e.g. cost, yield, risk, margins).

(b) Partnerships & Regulatory Setup

Select BaaS / fintech partners (banking, payments, KYC/AML)

Engage legal & compliance to determine licensing, disclosures, risk limits

Build necessary contracts or agreements (with banks, underwriters, providers)

(c) Platform Architecture & API Layer

Refactor or modularize your system to make finance modules pluggable

Develop API layers for account, disbursement, reconciliation, webhooks, etc.

Build event-driven connectivity with payroll execution engine

(d) Internal Risk & Operations

Design underwriting logic, risk guards, escalation paths

Build reconciliation, accounting, offsetting mechanisms

Define fraud, monitoring, and exception workflows

(e) Pilot with Select Clients

Identify a small cohort of clients (e.g. 10–20) to test EWA, wallet, or advance features

Collect feedback, observe adoption, measure metrics (utilization, default, satisfaction)

Iterate UX, flow, risk thresholds

Phase 2: Expand & Layer (H2 2026)

(a) Expand Product Suite

Add new modules: small loans, savings, insurance, rewards, etc

Geographic expansion: launch embedded features in new jurisdictions

Introduce cross-border or FX features if global payroll is in scope

(b) Go-to-Market & Sales Integration

Train sales and customer success teams on embedded finance benefits

Embed finance in product positioning, collateral, RFPs

Upsell embedded modules to existing clients

(c) Deepening Analytics & Personalization

Use payroll and wallet data to drive predictive modeling, segmentation, offers

Personalization: recommend advances, savings nudges, or loans

Monitor KPIs: activation, retention, default, NPS, LTV

(d) Internalization & Gradual Build-out

Migrate critical modules (e.g. underwriting, risk, reconciliation) in-house if beneficial

Fine-tune pricing, limits, algorithms

Continue compliance and audit readiness processes

(e) Marketing & Education

Launch content, webinars, case studies to educate clients and employees

Highlight adoption success metrics, ROI, retention stories

Phase 3: Scale & Optimize (2027 and beyond)

Fully integrated embedded finance becomes a core pillar

Optimize capital structure, margin expansions, and credit facilities

Expand ecosystem: fintech partnerships, marketplace, third-party extensions

Constant iteration on UX, AI-driven risk, cross-sell, and modular expansion

This phased approach allows payroll firms to mitigate risk, learn iteratively, and scale embedded finance responsibly.

By following a structured roadmap, payroll/HR firms can gradually embed finance while managing risk and capturing value.

Now let’s turn to practical recommendations on which modules to prioritize and how to measure success.

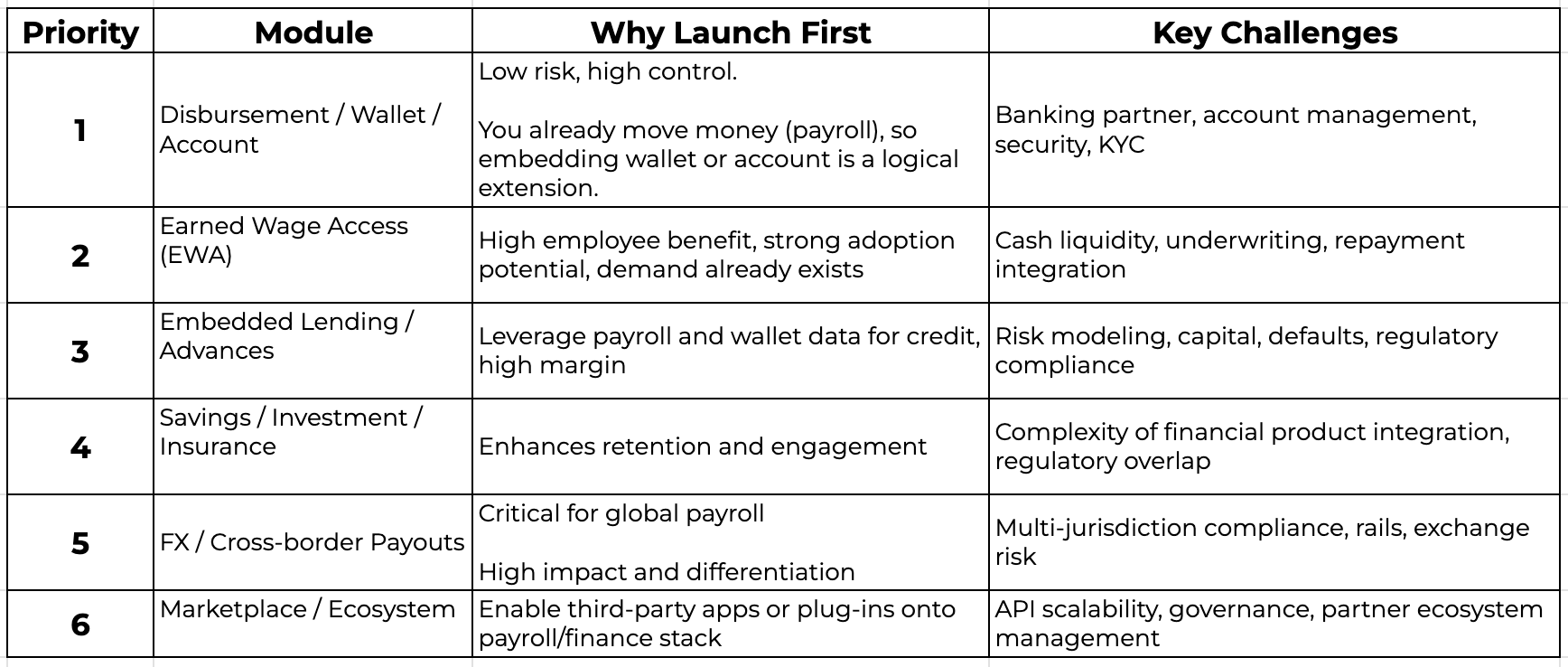

Prioritization: Which Embedded Modules to Launch First (in Phase 1)

Given limited resources and risk appetite, it’s wise to sequence embedded finance deployment.

Below is a prioritized stack and rationale for payroll/HR firms launching in 2026.

Rationale & Strategy

Start with what you control: Disbursement and wallet modules build familiarity with financial flows, integrate KYC, and create trust.

Launch EWA next: The incremental risk is manageable if you weave advances to payroll. Also, earned wage access is already demanded by workers.

THEN, add lending + savings: You’ll have the data and infrastructure to support expansion.

Global expansion later: Only once your stack is robust should you introduce multi-currency and jurisdictional modules.

This incremental approach reduces failure risk and helps generate adoption and data early, which can validate further investment.

Choosing the right modules to launch first can make or break your embedded finance journey.

Focus on lower-risk, high-impact features initially, then build outward into more ambitious financial services.

Measuring Success: KPIs and Metrics for Embedded Payroll Finance

Embedding finance is more than a feature build.

It’s a business transformation. You need meaningful KPIs to evaluate performance, iterate, and optimize.

Below are suggested metrics and frameworks for process and data infrastructure.

Key Metrics & OKRs

Adoption & Activation

% of payroll clients who enable embedded finance

Activation rate: % of employees using wallet, EWA, or advances

Time to first use: how quickly after launch do users transact

Engagement & Utilization

Frequency of use: average transactions per user per month

Volume of funds passed through wallet / disbursement rails

Penetration: e.g., % of wages routed through embedded wallet vs external accounts

Monetization & Yield

Yield per user: fees, interest, interchange, or swap revenue

Contribution margin: revenue minus cost of funds, risk losses, operations

Cross-sell conversion: % of clients upgrading to advanced modules (e.g. loans)

Risk & Credit Quality

Default / delinquency rate on advances / loans

Loss given default (LGD)

Fraud rate / anomalies

Chargebacks or reversals

Retention & Churn

Client retention vs non-embedded clients

Employee retention / satisfaction (via NPS or surveys)

Churn contribution: whether clients leave less after embedding

Operational & Efficiency

Cost per transaction / per advance

Reconciliation error rate

Time to resolve exceptions / disputes

Fraud false positives / negatives

Strategic / Long-Term Metrics

Lifetime value (LTV) of embedded clients

Return on invested capital (ROIC) in embedded modules

Market adoption growth or net new clients gained by embedding

Measurement Process & Data Infrastructure

Build dashboards early (e.g. internal tooling, BI)

Set targets before launch (e.g. activation 20% in year one)

Use A/B pilots or control groups to isolate impact

Constant feedback loops to refine UX, pricing, thresholds

Align metrics to executive visibility and accountability

By defining and tracking the right metrics, payroll firms can manage risk, optimize performance, and prove business value.

In the upcoming (second to last) section, we’ll highlight competitive examples to learn from.

Competitive Landscape & Case Studies: Who’s Already Doing It Well

Real-world examples provide powerful lessons about what works, what doesn’t, and how incumbents and fintechs are currently moving in payroll + embedded finance.

Here are notable players to watch.

Green Dot / rapid!

Green Dot’s rapid! solution evolved from payroll card to full embedded finance hub.

It now supports payments, tips, bonuses, contractor payouts, wallet features, and earned wage modules.

The company’s strategy: inserting itself in every employer-to-worker disbursement to build a comprehensive financial ecosystem.

U.S. Bank + Gusto Embedded Payroll

In September 2025, U.S. Bank launched an embedded payroll solution, integrating Gusto’s payroll tech directly into the bank’s digital banking interface.

SMB users now get a unified view of banking, payroll, and payments.

This move signals that banks see payroll as a battleground for client stickiness.

ADP Embedded Payroll

ADP, a giant in HR/payroll, has begun offering ADP® Embedded Payroll, enabling SMB software providers to embed ADP’s payroll system into their own apps.

This is a reverse embed — ADP is becoming the “banking/finance engine” for other platforms.

It reflects industry consolidation: HR incumbents not only embed finance but allow embedding by others.

JPMorgan + Gusto (Earlier, but illustrative)

Even before 2025, JPMorgan worked with Gusto to embed payroll into its banking product, enabling clients to run payroll within the same interface they manage banking.

Though not entirely new, it serves as a blueprint for how banking + payroll convergence can play out.

Some HR tech firms are embedding “perks” wallets, or in-app savings, to stickier retention.

Observations & Lessons Learned

Start simple, expand later: Many providers begin with disbursement or wallet before layering credit.

Deep integration matters: Tight coupling with the payroll execution workflow (e.g. real-time triggers) is crucial.

Cross-institutional partnerships: Banks, fintechs, HR providers are collaborating more (e.g. U.S. Bank + Gusto).

Regulatory caution: Some pilots stop or scale slowly due to legal or compliance friction.

Differentiation via user experience: Smooth UX, minimal friction, clear value to employees are critical.

These case studies underscore that embedded payroll finance is not hypothetical — it’s live and accelerating.

Payroll/HR firms have rich models to learn from and benchmarks to aim at.

Go-To-Market & Adoption Strategy for Payroll / HR Platforms

Even a well-built embedded finance module will fail if it doesn’t achieve adoption.

Payroll/HR firms must think strategically about go-to-market, client education, and incentive structures to succeed.

A. Segment & Pilot Selectively

Start with existing high-trust clients or innovative early adopters

Choose industries with demand (e.g. hourly workforce, gig, SMBs)

Run pilots to get case studies, feedback, reference clients

B. Incentivize Adoption

Offer embedded finance modules as free or discounted during pilot phases

Bundle finance modules into premium tiers or packages

Revenue sharing or rebate incentives to clients who drive volume

C. Education & Change Management

Train account management and sales teams to pitch embedded finance

Create educational content, webinars, use-case narratives

Position the benefits: improved retention, lower turnover, better financial wellness

D. UX & Onboarding Design

Minimize friction: one-click enablement, simple KYC flows, progressive disclosure

Use tooltips, walkthroughs, nudges, and progressive adoption

Leverage notification flows (e.g. “Would you like to access wages now?”)

E. Marketing & Thought Leadership

Publish white papers, blog posts, case studies about embedded payroll

Host industry webinars and panels on embedded finance in HR

Speak at industry conferences (HR tech, fintech, payroll)

Use SEO-optimized content (like this article) to drive inbound leads

F. Expand via Partnerships

Integrate with banks, fintechs, benefit providers, accounting platforms

Offer embedded finance to the partners of HR/payroll (e.g. apps, vendors)

Build referral programs or co-marketing agreements

G. Feedback Loops & Iteration

Collect usage data, user feedback, NPS, churn signals

Iterate UX, risk thresholds, product flows

Use A/B testing on pricing, flows, prompts

Successful embedded finance deployment hinges not just on tech — it’s about adoption, incentives, and education.

If you build it and don’t promote it, usage will lag.

Prioritize pilots, marketing, and feedback from day one.

Risks, Pitfalls, and Mitigations

No transformative project is without risk.

Embedding finance into payroll is rife with pitfalls — but many can be mitigated with planning and caution.

Here are key risks to watch for and strategies to manage them.

Regulatory / Legal Risk

Pitfall: Misclassifying wage advances as credit, violating wage laws, or running afoul of money transmitter regulation.

Mitigation: Engage counsel early, restrict scope initially, use partner BaaS, and build compliance guardrails.

Credit / Default Risk

Pitfall: High default rates or losses from advances or embedded loans erode margin.

Mitigation: Conservative underwriting models initially, caps per user, tight integration with payroll offset, dynamic risk limits, and continuous monitoring.

Liquidity Risk

Pitfall: Funding advances without sufficient capital leads to cash crunch or funding gaps.

Mitigation: Secure committed capital lines, partner with banks, model cash timing carefully, and gradually scale.

Fraud, Identity, & Security Risk

Pitfall: Fake accounts, identity theft, laundering, or internal bad actors exploiting wallet flows.

Mitigation: Robust KYC/AML, fraud detection systems, anomaly alerts, identity verification, and security best practices.

Adoption Risk

Pitfall: Low usage or resistance from clients/employees; embedded features being ignored.

Mitigation: UX focus, incentives, onboarding support, phased rollout, user education, A/B testing.

Reconciliation / Accounting Errors

Pitfall: Mis-accounting advances, offsets, reversals leading to financial discrepancies.

Mitigation: Rigorous reconciliation systems, audit pipelines, accounting controls, thorough testing.

Partner / Vendor Risk

Pitfall: Reliance on a fintech/BaaS partner that fails, changes terms, or faces outages.

Mitigation: Diversify providers, maintain fallback paths, retain ability to internalize key modules over time.

Reputation Risk

Pitfall: Missteps with advances or defaults could damage client trust in core payroll product.

Mitigation: Start conservatively, monitor early, communicate openly, provide safety nets (dispute resolution, override flows).

While embedded finance has reward potential — it’s not without danger.

Success lies in prudent design, phased scaling, and constant vigilance.

A well-mitigated launch will help turn risks into competitive moat.

SEO & Content Strategy to Drive Inbound for Embedded Payroll Finance

To succeed, you’ll need not just product but demand.

Thought leadership, SEO, and content marketing play pivotal roles in attracting HR/finance buyers.

Below are recommendations (alongside this article) to position your embedded payroll finance offering in search and industry discourse.

A. Keyword Strategy

Focus keywords like:

embedded finance in payroll

payroll fintech

on-demand pay / earned wage access

HR embedded banking

embedded lending payroll

payroll + wallet

embedded payroll platform

modern payroll innovation

Ensure long-tail phrases: “embedded finance solutions for payroll companies,” “how HR software can embed banking,” etc.

B. Cornerstone Content

Create in-depth pillar articles:

“What is embedded finance in payroll?”

“Earned wage access: how it works and why it matters”

“Case studies: payroll providers embedding finance”

“2026 roadmap for payroll/HR firms to embed banking”

Link these from product pages, blog posts, and partner content.

C. Guest and Partner Content

Publish guest articles on HRTech, Fintech, payroll industry blogs

Partner with banks, fintech vendors to co-publish

Webinars, podcasts, panel discussions on embedded payroll finance

D. Thought Leadership & Research

Conduct surveys of payroll/HR decision-makers on attitudes to embedded finance

Publish original research or benchmarks

Release whitepapers, e-books, infographics targeting CFOs, CHROs

E. SEO Technical Best Practices

Schema markup (FAQ, how-to, blog)

Internal linking to strong pillar pages

Optimize meta titles, descriptions with embedded finance keywords

Use relevant images and alt text

Fast loading, mobile optimization (HR/finance execs often review on mobile)

F. Use Case & ROI Stories

Publish customer success stories with numbers: “Client A saw 15% lower turnover”

Compare before/after in embedded finance adoption

Use metrics—activation, yield, retention—to make stories compelling

G. Lead Generation & Gated Assets

Offer gated assets (ROI calculator, whitepaper) in exchange for leads

Use email nurture campaigns centered around embedded finance themes

Use calls-to-action in blog posts to invite pilots or demos

SEO and content strategy are essential to making your embedded payroll finance offering visible and credible.

By mastering thought leadership and search presence, you can attract inbound interest from HR, finance teams, and decision-makers.

Final Thoughts & Call to Action for Payroll/HR Leaders in 2026

Embedded finance in payroll is no longer a distant frontier — it’s rapidly becoming table stakes.

The “Payroll Playbook” shows that wage flows present one of the stickiest, most underexploited channels for embedding financial services.

Payroll and HR firms that act in 2026 stand to unlock deep monetization, differentiation, and long-term customer lock-in.

Summary of Key Themes

Payroll is a compelling anchor for embedded finance because of its frequency, data richness, and centrality to operations.

Use cases range from wallets/disbursement to EWA, lending, savings, and cross-border FX.

Strategic prioritization suggests starting with wallet/disbursement, then layering in EWA and lending.

Implementation demands attention to architecture, risk, compliance, partnerships, and UX.

Measurement, adoption strategy, and SEO-driven content are vital to success.

Learning from competitors (Green Dot, U.S. Bank, ADP) helps you benchmark and avoid pitfalls.

Recommendations for Payroll/HR Firms

Commit now to strategic planning — draft your embedded finance product vision for 2026.

Begin with low-risk modules (wallets/disbursement) to gain operational experience.

Partner wisely — start with BaaS or fintechs, but plan for internalization over time.

Pilot aggressively — get feedback, capture metrics, refine UX, and build use cases.

Educate your market — content, SEO, webinars, case studies to open the narrative.

Measure everything — build dashboards and internal data culture focused on activation, risk, yield, and retention.

Don’t wait too long — incumbents and fintechs are already charging ahead. The window of opportunity may not last forever.

Call to Action

If you lead a payroll, HR, or workforce platform, now is the time to explore embedded finance. Start with a feasibility study, pilot a wallet or EWA module, and begin building the technical and compliance foundation to scale in 2026. Your platform can evolve from being a transactional tool to becoming the financial engine that employees and employers depend on daily.