The Real Risk Private Investors Miss in Trading

FEATURED POST

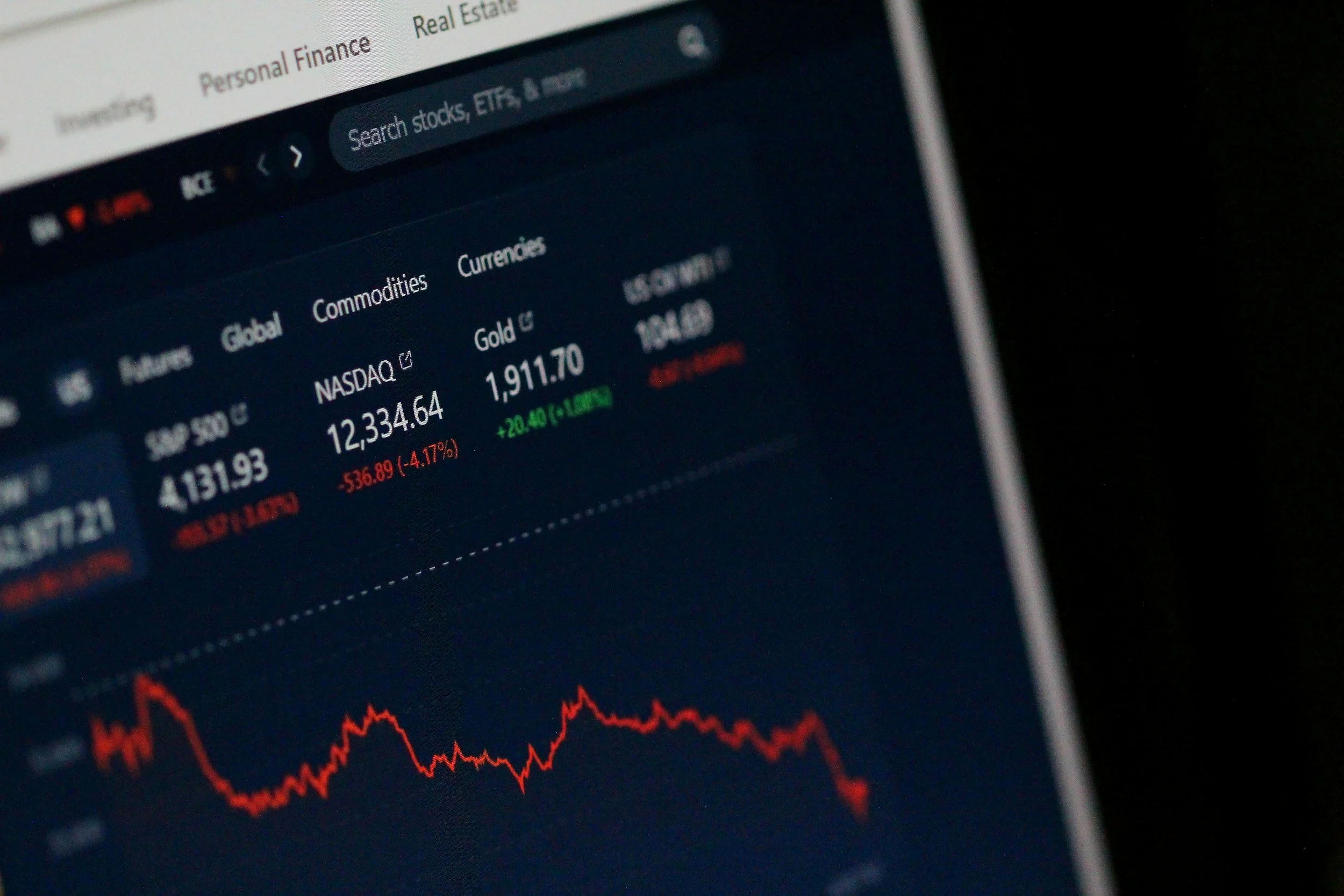

When it comes to investing in crypto (and other assets), the truth is it’s not always the volatility of the market that causes people to lose money.

Investors lose money when they misunderstand where the actual risk sits, and then volatility gets the blame because it’s visible and romantic.

That’s the thing: if one aspect is being blamed, the other risks go unnoticed. And when just under 7% of the world’s population has some type of balance in crypto, the potential for losses is huge, both at an individual scale and a collective one. And once you make a mistake, you can guarantee someone else will be there to take advantage of your loss.

This post is going to look at some of the real risks of investing that are often overlooked or missed, especially for those new to trading.

Overconfidence and Self-Directed Trading

One of the main risks that insiders and experts come across time and time again is overconfidence. And this is built early.

All it takes is a few good trades, and this makes people feel like they have a real skill, leading to overconfidence. Then, private investors start trusting instinct, and suddenly, position sizes creep up, risk limits disappear, and losses are brushed off as temporary.

In particular, crypto amplifies this because feedback is instant — prices move fast, trades execute quickly, and gains feel earned in the movement. But this leads to a loss of structure, and when the market turns, that trader who was in control is suddenly reacting, not deciding, and they end up in trouble fast.

Investors who avoid this limit exposure before they ever place a trade. They decide position size first. They treat early wins as market conditions, not proof of skill, and they keep risk limits fixed even when confidence rises.

The goal here isn’t to eliminate emotion, but to control it and prevent it from changing exposure.

Poor Risk Management

Let’s be real, many private investors enter trades without planning the exit.

There is a buy price, but there is no clear point where a trade is considered wrong. Stop losses are ignored or removed once emotions kick in, and they hold losses in the hope they’ll “come back”.

However, this can all be easily avoided.

You need to put exit plans in place before you even start trading.

You need to know what you are willing to tolerate before you quit and stick to it before it’s even a reality. And investors who go the distance in crypto know that they define the point where the trade is invalid and act on it without negotiation.

Misunderstanding Liquidity Slippage

Liquidity looks good until it matters. And headline prices can give the impression that assets can be bought and sold easily. But in reality, execution tells a mostly different story.

Thin order books, especially outside major pairs, mean executions can often happen at worse prices than expected.

What can you do to reduce this risk?

Successful investors reduce this risk by trading assets with sufficient depth for their position size and by testing exits, not entries. They factor slippage into expectations and avoid scaling beyond positions that the market can realistically absorb.

Ignoring Fees, Spreads, and Execution Costs

It’s important to understand that those small costs can and do add up quickly.

Fees, spreads, and execution quality have a larger long-term impact than you might realize, especially for frequent traders. And for those new to crypto, this might not be obvious immediately.

This is where infrastructure choices matter.

Platforms like FXCOINZ sit in the execution layer that many retail investors overlook. Their pricing mechanics, spread behavior, and trade execution influence results more consistently than headline fees.

Investors who take this seriously evaluate platforms based on how trades are filled, not just how they look on the surface.

No Strategy for Market Cycles

It’s a common trend for investors to apply the same approach to every market condition.

They trade aggressively in downturns and hesitate during growth phases. No adjustments, just reactions. And here’s where things inevitably fall apart.

You can easily avoid this risk by defining behaviors for different market phases.

Experienced investors will reduce exposure during contraction, increase selectivity during growth, and accept that sitting out is a valid decision.

You need to change strategy with conditions, not momentum, for optimal results and lowered risk.

Regulatory and Access Risk

Regulatory changes can often be ignored until they restrict access.

Platform rules change, jurisdictions change, and assets become unavailable without notice. Then it becomes a problem, as inexperienced investors have no plan in place for this.

But those who do manage this risk diversify access, stay informed about platform exposure, and avoid concentrating funds where continuity isn’t guaranteed.

Access is treated as part of the risk management plan, not an afterthought.

Chasing Signals and Noise

Crypto produces constant information.

It’s all charts, alerts, influencers, and “must-watch” narratives that create the illusion of opportunity. And traders, especially private ones, will trade because something is moving, not because it fits a defined strategy.

Avoidance here means having fewer inputs, not better ones.

It means trading less often, ignoring most signals, and only acting when conditions meet preset criteria.

Security and Custody Risks

Losses don’t just come from bad trades. Weak security practices remain one of the most avoidable risks in crypto (and investments overall).

Security risks are often the result of poor passwords, reused credentials, and a lack of two-factor authentication, which instantly expose accounts.

For the most part, these risks are easy to avoid. You need to position security as a priority and make it non-negotiable.

Separate trading capital from long-term holdings, use strong authentication by default, and assume platform access can fail at any time. Reduction in convenience is what protects capital.

Trading isn’t just about picking the right part — it’s about managing behavior, execution, security, and access in a market that moves fast and forgives very little.

The investors who last aren’t the ones who avoid volatility.

They’re the ones who build systems that spot preventable mistakes before they do permanent damage.

NOTE: The discussion in this article illustrates challenges for the investing / trading community. Cryptocurrency or investing is not being recommended or endorsed. These activities involve significant risks, and individuals should only participate after conducting their own thorough research and evaluating their personal risk tolerance. Always seek professional financial or legal advice before making related decisions.