Conference Recap: TechSummit SF

San Francisco is still alive & well as a top technology hub in the US. In-person industry events are slowly coming back to pre-pandemic levels. Office buildings may not be as occupied as before, but companies, funding, and deal-making is still taking place in the Bay Area.

Last week 2K+ attendees registered for a conference near Union Square for two days of industry discussions, most notably on artificial intelligence (AI) and its impact on the economy, current uses for existing tech firms, and what the future of work looks like.

Artificial intelligence is topic we touched on when we first started this community back in 2017, but between 2018 - 2021 the overall buzz died down.

Blockchain & cryptocurrency stood out as innovative technologies due to increasing adoption and momentum towards everyday uses. With the fallout of crypto in 2022 and heavy US regulation in 2023, crypto platforms no longer have market-accepted offerings for their users.

With cryptocurrency on the way out (for now), AI has come back bigger than ever.

The catalyst? Chat-GPT releasing to the public at the end of 2022.

In its first 5 days of release, the new product reached 1M users! No coding needed to use ChatGPT — only prompts from a user (in English), similar to searching for info online.

Here’s a quick recap of the TechSummit SF conference and key discussion points.

CONFERENCE OVERVIEW

The two day conference (June 22 - 23) was held at Hotel Nikko, just blocks away from Union Square. The list of panel discussions included speakers from top tech brands leveraging AI (such as Intel, SAP, Amazon).

For attendees, there was a wide variety of industry professionals networking and listening in on panels. Many individuals were part of IT staffing companies, software development agencies, and data analytics firms — either based in the US or international (LATAM and Europe).

As the tech industry adjusts to the current market downturn, companies are looking to be agile and cost-efficient when it comes to outsourcing talent and capacity planning. Leveraging contractors & freelancers on a hourly basis (that have been pre-vetted) can be a long-term savings in comparison to hiring & onboarding full-time teammates.

There were also students in attendance that recently graduated with MBA or MS degrees. These grads were eagerly making connections with firms hiring. In connecting with some of these students, it was clear that there was a struggle in finding new opportunities, especially as companies monitor expenses closely. For those on visas, there was an urgent need to find a new role within the next 60 - 90 days.

KEY TOPICS IN PANEL DISCUSSIONS

Artificial intelligence was the leading topic throughout the conference. Global recognition through Chat-GPT’s launch last year opened up the potential for business use cases and increased adoption. Panelists took turns answering questions about the future impact of AI on business, economy, and jobs. Here were a few of the top discussions:

FUTURE OF WORK (Thurs., 6/22)

This panel (including leaders from Quotient, Rodeo, Omneky) honed in on how emerging tech will shape the future workforce, specifically with advances in AI and robotics:

Robotic Process Automation (RPA) has already automated mundane tasks;

Generative AI (or Gen AI) is showing enhanced use cases, such as —>

Recruiting – filtering & analyzing candidates on platforms (e.g. LinkedIn, Dribbble);

Sales – helping draft a go-to-market (GTM) strategy for a new product;

Engineering – automating testing and drafting of code;

Healthcare — accessing patient records and medical history across states & providers;

As artificial intelligence continues to evolve, the emphasis will lean towards deriving strategic outputs. Manual task completion should be automated and outsourced (such as reporting and accounting). Employers can then strengthen business areas where they have a core competency.

For product teams in particular, AI can cut the risk out of program development as idea creation becomes a lot faster (leveraging prompts in Gen AI tools). Product managers can then apply their skill sets to providing feedback aimed at a finalized version.

For sales teams, autonomous agents can be trained with historical data on deals, recorded calls, company product info, and market data. These agents can then ‘coach the coach’ in future sales calls or draft follow-up emails that improve results based on past performance. AI tools are already providing meeting transcripts, summarizing calls, and recommending next steps.

New roles will be born from the increasing usage of artificial intelligence. An early opportunity is with ‘data labeling’ — necessary in sorting volumes of information before feeding in large language model (LLMs).

AI for TRAVEL MANAGEMENT AND EXPENSES (Fri., 6/23)

Many consumers & businesses using travel sites/apps to book trips do not comprehend what goes on behind the scenes in terms of recommendations.

The airline & hotel industries use complex algorithms to maximize revenue opportunities and improve their user experience. Machine learning helps predict which fares and rates would be most relevant in minimizing empty seats on planes and empty rooms in hotels. 90% of flights & hotels are chosen from top 10 results!

Attributes considered in posting results include:

For hotels: Client preferred hotels, Client negotiated hotels, Distance, Availability, Price, Reviews, Booking frequency, Previous traveler booking, Previous coworker bookings, Loyalty cards;

For airlines: Policy, reasonable flights definition, Lowest price, Number of stops, Duration, Departure\arrival time, Previous traveler booking, Previous coworker bookings

With an AI-enhanced traveler experience, users are able to enjoy ease of use, personalization, and productivity from modern booking platforms. The next evolution in this sector from AI would be chat-based experiences for existing clients who previously booked travel and would like similar accommodations.

THE FINTECH WAVE IS NOT BEHIND US (Fri., 6/23)

The best panel (you know we’re biased towards fintech) was from Fiat Ventures (Alex Harris). The discussion started off highlighting customer experience from fintechs — the US Fintech average for NPS (Net Promoter Score from surveying client satisfaction) was 83 in 2022, compared to 23 for US Banks. Top fintech companies leading the industry with NPS include SoFi, Affirm, LendingClub, and Funding Circle.

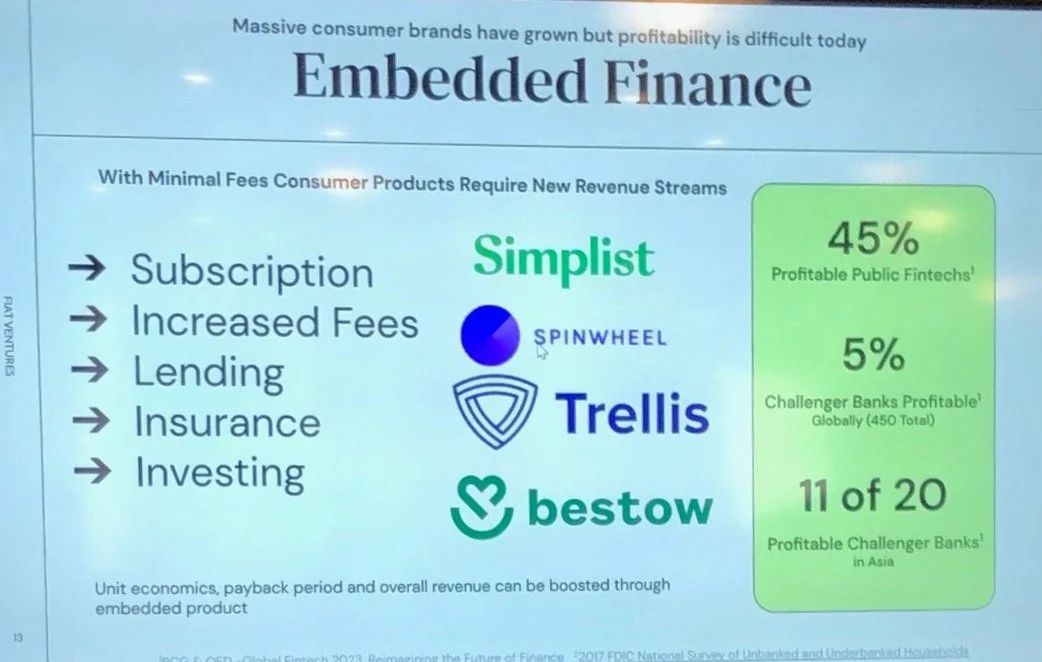

Despite the fintech sector greatly struggling (only 45% of public fintechs are profitable), future industry growth is expected to come from Embedded Finance — specifically from massive consumer brands.

Unit economics, payback period (how long it takes to earn revenue from a user that pays for their acquisition cost), and overall revenue can be enhanced by embedding banking products. Revenue streams can come from subscriptions, increased fees, lending, insurance, and investing.

For mid-sized companies in adjacent (non-banking) verticals, a growing movement in the industry is being labeled as Fintech+. New solutions are being built into non-financial companies as way to boost revenue and customer experience.

Healthcare, Climate, Future of Work, Web3, and eCommerce companies are looking to capitalize on 88% of consumers having experience with a fintech product.

Democratizing wealth & investment management is also expected to grow over the next decade. This involves the shift of ownership of assets, goods, and value towards fractional shares of ownership that are digital.

We’ve covered this topic of alternative investments in detail with examples in real estate (commercial, multi-family rental), collectibles, and luxury goods.

Lastly, a point resonating across all tech firms — ‘growth at all costs’ is no longer relevant. It’s all about capital efficient growth, which relies on the effective deployment of funding.

Key concepts and best practices include:

Test & iterate constantly;

Search for fixed CPAs (cost per user acquisition) to avoid these expenses continuously increasing in the long run;

Focusing on funnel & customer journey optimization;

Minimizing payback period is a critical investment metric — less than 8 months is good, and less than 6 months is great;

People capital is a crucial priority — hiring the right personnel, building a strong team culture, and retaining top talent;

FINAL TAKEAWAYS from the CONFERENCE

Throughout the other 10+ panels, there was a mix of key points that hit a chord and should be mentioned as well.

In thinking about AI in everyone’s hands:

It’s critical to think about projects holistically that optimize for quality business outcomes (not only task completion);

Deploying against transformational use cases will help companies leapfrog their future performance (and competitors);

AI’s impact is currently specialized & siloed (not reaching across departments in an organization), and some companies have a ‘black box mindset’ (in which users are unaware how decisions / recommendations are made);

Current problems are linked to data quality, latency, memory, and database performance;

The AI of tomorrow is expected to have multi-task & full integration capabilities (throughout an organization) and be transparent & explainable to the everyday user;

Overall, the conference felt like an industry meetup in San Francisco. The layout of the venue, small size of exhibitors, mix of attendees, and emphasis on AI made TechSummit a bit different than other fintech/banking focused events we’ve attended this year.

If the event comes back next year, we’d like to see more variety in topics — AI, fintech, blockchain, web3, payments — and better meeting schedulers (in-app) with networking events in the evening.

Join our community @FinTechtris for more industry content & insights (including deep dives & sector spotlights).

As a bonus, access our subscriber-only resources for evaluating and building the next generation of financial services. Signup today !